Do you have a digital financial life money organizer? Well, you should.

Do you use a digital financial life money organizer?

Several years ago I developed what my mother brilliantly termed a financial “Grab and Go” 🏃🏿♀️– a tool 🛠 that helps clients collect and organize the financial documents 📑 you should bring with you in the event you had to leave your home suddenly. For those clients who prefer working with paper, I still offer my services to help them develop their own Grab and Go.

However, I’m increasingly seeing clients moving away from papers, towards a digital version of their financial life money diary. I have a process and tools that help my clients aggregate their accounts and important policies and documents into one, secure, online portal – which can be accessed from anywhere – at any time. My financial planning tool 🔧, which provides my clients with their own, personal financial portal, is called eMoney.

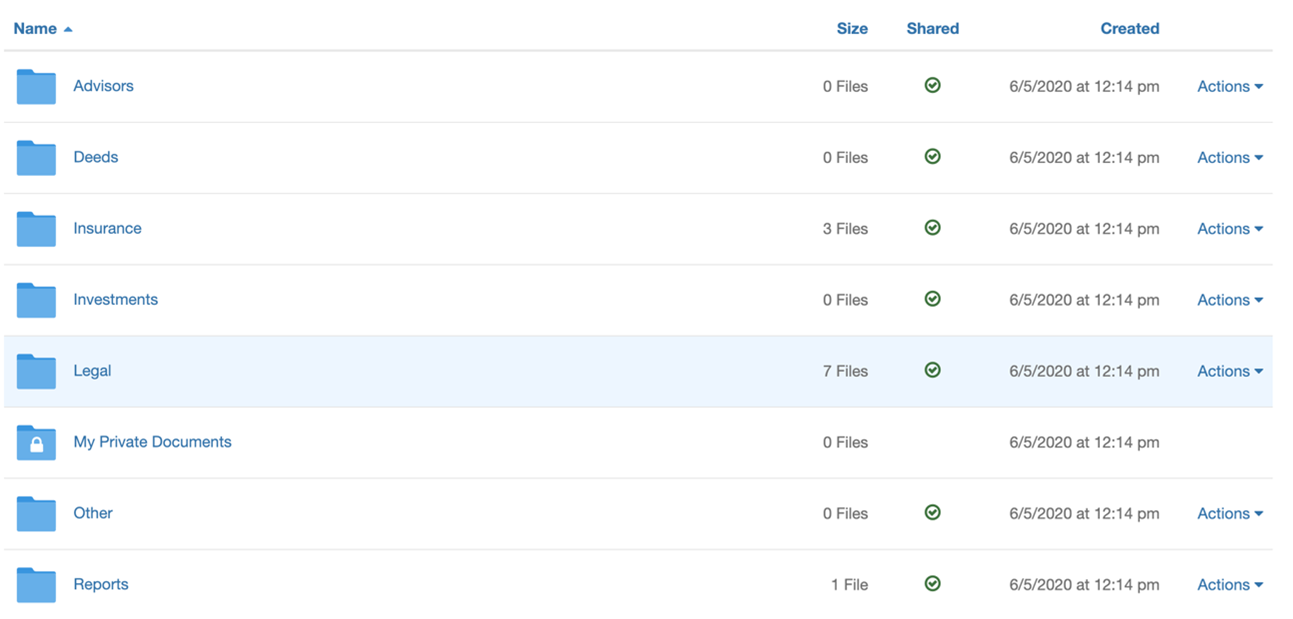

See below for a screen shot of my electronic 📲 financial diary I offer my clients.

We can organize the files as appropriate for each client – but we often see many documents in the LEGAL and INSURANCE folders. Clients also have the capability to store private documents, pictures, and other precious files, with unlimited data storage options.

Secrets of the Grab and Go (digital financial life money organizer)

So now let’s turn to some secrets 🕵️♀️ of the Grab and Go (digital financial life money 💵 organizer). I will share with you some of the more urgent items that everyone should be reviewing, revising, renewing, or even addressing for the first time. Some of the most important documents to keep on hand are copies of ALL insurance policies.

Typical clients may have the following:

Life insurance: If you are employed by a firm you may have a policy via work (grab a copy and be sure you’ve put the appropriate loved ones on as beneficiaries) AND private life insurance📝 (most employer-provided life insurance does not follow you when you change jobs – so many of us supplement with an individual policy). I highly recommend reviewing your coverage periodically and would love to help. Many people I talk to do not understand what they have for coverage, and/or do not have enough to support their family’s needs.

Disability insurance: Ditto above. You may have a policy through work, and may also need private coverage as well.

Property & Casualty insurance: Be sure to collect your home, auto, commercial, and umbrella liability coverages and know who to contact. And NOTE – if you do NOT currently have an umbrella liability coverage, contact me today to discuss this further.

Estate planning docs:

Today, I’m really concerned with younger parents drafting a will (and deciding who would become guardians of their children should something happen – especially single parents!)

Older parents should revise theirs – especially once they have adult-children who could potentially serve as guardians of younger children 👶🏽.

Power of Attorney 👩🏻💼: Can your spouse or a loved one act as an authority on your behalf for legal or financial matters should you become incapacitated? This is SO important today!

Health Care Proxy: This allows you to appoint someone else as your agent for medical 🩺 decisions should you need it.

Please note – if you have adult children 👨👨👦👦, you should consider helping them work with an attorney to draft these docs. I know that current times made me nervous, and I went through this exercise with my oldest daughter, and now starting with my second.

Medical contacts 🚑: Personally, I’ve seen COVID result in medical providers moving quicker than ever to go online with their portals. This results in a LOT of user names and passwords to remember. It is really important to keep note of these in my Grab and Go.

Also, while online access is important, so is a simple record of all providers with their contact info – especially if you tend to manage the health needs of multiple family members!

Business 📊 documents:

For clients who run their own businesses, we have many more documents to add to the long list of personal documents.

If you are a spouse of a business owner, and you do not have a complete picture of the family business, contact me today to help you gain a clarified view, and be sure your business is properly structured for maximum protection and to optimize growth 🌱opportunities.

Photos 🌠:

I know that my family photos are precious 🐣. We have multiple ways of keeping digitized versions. Be sure that your family has a way of protecting them and sharing the access to them so that you can always retrieve them if need be.

Further, while accessing your Grab and Go, or your digital financial life money organizer, you are not only organizing and collecting your important documents and data, but you are also getting a clear picture of where you stand financially.

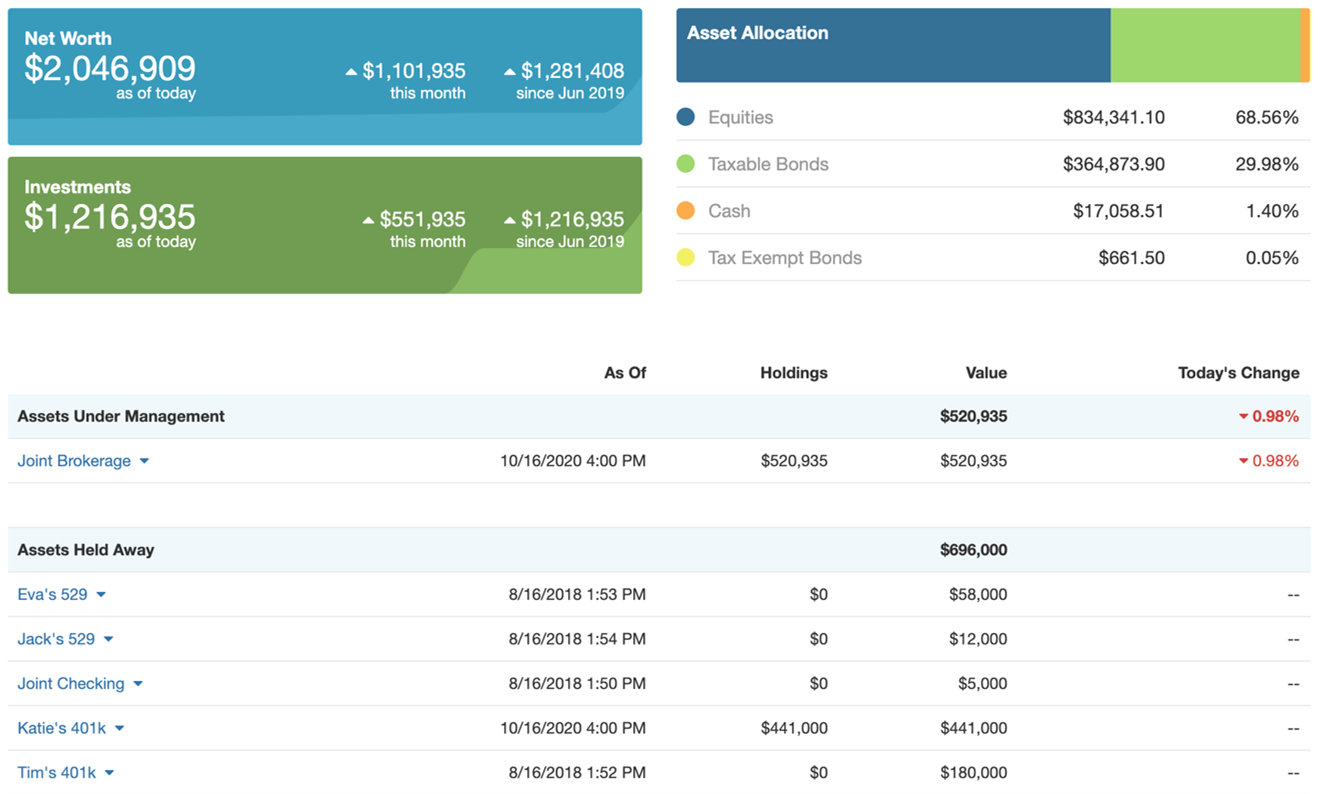

See below a screenshot from one my sample clients – we can see daily where their net worth 💲stands – and make readjustments to their financial plan 🗺 where necessary. Here you can see all of their accounts listed in one place, their net worth, as well as their allocation mix of stocks and bonds.

When my clients can see their entire financial picture in one place, VISUALLY, 🤓 it really helps them prioritize financial planning moves to make to adjust their own progress to desired goals accordingly.

In closing, there are so many more important financial, business, and personal documents that this blog would continue for pages. This was just a smattering of necessary documents 🗂 and accounts and policies that I help my clients obtain, review, and organize regularly. If you’d like to learn more about how YOU can start this process, please contact me today. I look forward to connecting! 😀

Please note, content in this material is for general information only and is not intended to provide specific advice or recommendations for any individual.